Over recent years, Google has been pushing its arsenal of automated solutions more and more. All of these solutions have a common goal – to reduce the amount of manual work and optimisation that a PPC manager may need to perform – so that’s nice of them…right?

Well, until now, many of these solutions have shown mixed results and a number of seasoned PPC experts have been left casting a cynical eye over new automated features. Essentially, the thinking has been, “less work for the same or better results – is it just too good to be true?”

The latest automated Google Ads feature to be rolled out across the board is Smart Shopping Campaigns. With Google Shopping being such an important channel for one of our PPC clients, Powertool World, we wanted to test the new campaign type to see how it stacks up against a proven performer.

First things first, what are Google Smart Shopping Campaigns?

The premise of Smart Shopping Campaigns essentially comes from Google’s ‘micro-moments’ theory, which is used to explain consumer behaviour and how it affects the customer journey. The theory being that in the current digital landscape, users will hit specific touchpoints or ‘micro-moments’ during their shopping journey and their needs must be fulfilled if you want to convert them into customers:

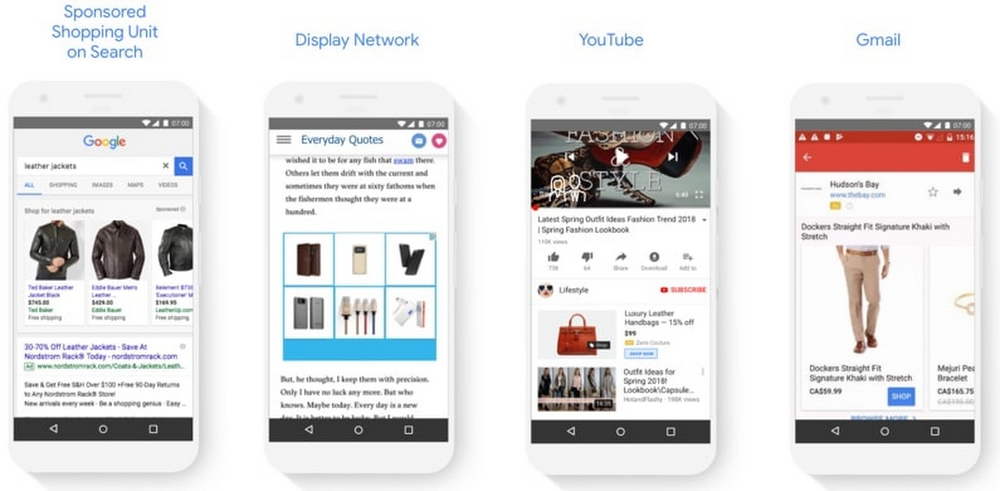

Smart Shopping aims to deliver on each of these micro-moments by combining the power of automation and machine learning with multiple ad networks. So your products won’t only appear on the search network in the form of shopping ads, they will also be served through dynamic remarketing ads on the GDN, YouTube and Gmail.

Therefore, you will be maximising your chances of getting in front of potential customers whilst they navigate their way through the micro-moment journey. In theory, the automated system would show the correct products, in the correct place, to the correct audience and at the correct time.

Rolling all of these features into one, handy integrated campaign drastically saves time on set-up and management whilst maximising reach. Assuming you have a robust and well-structured shopping feed in place along with healthy remarketing lists, the creation of these campaigns is relatively straightforward. You do just need to ensure that a default ad is included for the rare times that a past site user has not visited a product page.

All that’s left to do is select a budget and bidding strategy for the campaign. The bidding options are either maximising conversion value or maximising conversion value at a specific return on ad spend (ROAS). Many advertisers (especially those with strict ROI targets) will be tempted to select the ‘specific ROAS’ option from the off. However, it is advised by Google to let the campaign run with the ‘shackles off’ (to a certain extent) at least for the first few weeks in order to give the automated bidding the best chance of performing and learning. Once the learning phase has been completed, a stricter ROAS target can then be applied.

So…do they work?

We run a large scale, high volume Google Shopping Campaign for Powertool World. It is fundamentally one of the most important revenue generating channels that the business holds. Because of this, any change to the setup or structure of the campaign cannot be taken lightly.

It was decided that if we were to trial Google Smart Shopping, then we would need to select brands that have a high enough volume of sales but are not the main revenue drivers for the account. The ad groups for these brands were paused in the regular Shopping Campaign and product groups were then created in a new Smart Shopping Campaign. That way, we could compare ‘like for like’ performance whilst ensuring that the campaigns do not compete with each other.

We have to caveat any performance figures with a couple of limiting factors:

- The account is highly seasonal so comparing anything other than year on year trends is likely to be at least slightly misleading.

- We have only been running the Smart Shopping campaign for a few weeks, so it hasn’t yet had a huge amount of time for the automation to ‘learn’ and optimise. Google says that the initial learning phase will last around two weeks in most cases.

Comparing the first 23 days of Google Smart Shopping in August 2018 to the regular Shopping ad groups for the whole month of July 2018 gives us these headline stats:

| Sales | Revenue | Clicks | Impressions | ROI |

|---|---|---|---|---|

|

↑ 40% |

↑ 48% |

↑ 86% |

↑ 185% |

↓ 16% |

So with a week of running left in August (at the time of writing), sales are already up by 40% and revenue by an even greater amount (48%). This alone is reassuring, seeing as the automated bidding is set to maximise conversion value.

As you would expect with the additional ad networks, clicks and impressions are significantly higher with the CTR dropping – no great shock.

The crucial one though is ROI. Although we have so far seen a small drop, the ROI is still very high and within the established targets that we optimise to. Given that the overall volume is much higher, the slight ROI decrease is nothing too much to worry about. In theory, with more data and longer to learn, the campaign should start to improve this important metric. We also have the option to change the bidding strategy to focus more on ROAS going forwards.

Conclusions

From a cynical PPC practitioner, it is refreshing and encouraging to know that the automated options becoming available to advertisers (across the board, on all channels) are improving. Google Smart Shopping appears to be one of these ‘improving’ options in Google Ads.

At least from our isolated test, Google Smart Shopping does appear to be the real deal. Essentially, it is managing to increase our sales volume and revenue whilst still achieving a strong ROI. Albeit, the ROI (so far) isn’t as strong as we have previously seen from this small test group of brands.

One of the main limiting factors with Smart Shopping is the lack of control we have over bidding. Having said this, you shouldn’t need to have much control as the system takes care of everything for you. However, there are times when we want to have a tighter grasp on bid adjustments, placements and ad formats, so Smart Shopping won’t always be suitable.

Along with this, as great as it is that ads are served on multiple networks from just a few clicks of a button, the visibility on where and when they are appearing seems to be very limited. It is also a little unclear how the ads will look when they are served, which might not sit well with some clients. You really do need to just trust the system, but if the results are as strong as we have seen in our initial test, then this should be easy to do!

If you would like to find out more about shopping campaigns or PPC in general, then please get in touch with the team today.